News & Media

4 November 2025

KNIGHTHOOD ATTENDS AACO’S 58th AGM IN RABAT

Knighthood Chairman James Hogan and Chief Executive James Rigney attended the Arab Air Carrier Organisation’s 58th AGM in Rabat, Morocco, which was held under the High Patronage of His Majesty King Mohammed VI. Knighthood was once again a Gold Sponsor of the event, which is an important annual fixture in the aviation calendar of Middle East and North African airlines and industry partners, and a critical platform to address the diverse regional challenges and share unique information and insights to a wider audience.

24 October 2025

James Hogan AO speaks at the Pacific Tourism Organisation (SPTO) Council of Tourism Ministers Meeting

The global airline industry offers huge economic and social benefits far beyond the airline business. But the right connectivity is fundamental to a resilient and successful airline that can generate these benefits.

Organic network growth must be supplemented through collaboration and partnerships to create the necessary scale to compete and be sustainable in the long term.

In his presentation to the South Pacific Tourism Ministers, James Hogan, outlined optimal models for network growth and how to harness the benefits of tourism in the region.

He also emphasised the importance of a cohesive regional strategy implemented together with private enterprise to align the objectives of aviation and tourism, including hotels and entertainment venues, and how this would benefit the local economies and peoples of the South Pacific Islands.

In a closing he said that connectivity was not just about flights, but about prosperity, resilience and unity across the Pacific.

2 October 2025

Knighthood Global Chairman to address council of tourism ministers meeting in Vava’u, Tonga

Airlines are the lifeblood of the global economy and a fundamental driver of tourism

Knighthood Global Chairman, James Hogan AO, has been invited by the Pacific Tourism Organisation (SPTO) to speak at the upcoming Council of Tourism Ministers Meeting, taking place in Vava’u, Tonga, as part of the annual Pacific Islands Tourism Ministers’ Forum from 20 to 22 October 2025.

A distinguished veteran of the airline industry, Mr. Hogan brings four decades of leadership experience across start-ups and large-scale transformation projects in global aviation.

In an initiative facilitated by UNSW Sydney, School of Aviation, he will deliver a keynote address centred on the theme ‘Connecting Tourism and Aviation’. In his remarks, Mr Hogan will underscore the critical role aviation plays as an economic enabler and a foundational element in national strategic planning. Drawing on real-world case studies and successful airline models, he will illustrate how building a fit-for-purpose network, underpinned by the right fleet can unlock economic potential through increased foreign investment, business growth, job creation, and inbound tourism, all of which are vital to the prosperity of Pacific Island nations.

He will also explore strategies for network expansion, including the use of codeshares and strategic partnerships, showing how underserved markets can be transformed through improved connectivity. These sustainable approaches offer long-term solutions to enhance access to and from the island nations that make up the region.

Following his address, James will join an open panel discussion alongside regional tourism ministers and aviation experts to further examine the opportunities and challenges facing the Blue Pacific Continent.

The keynote appearance of James Hogan at the SPTO Tourism Ministers’ Forum is part of a partnership between SPTO and UNSW Sydney, School of Aviation to address aviation challenges in the region by facilitating a collaborative approach, bringing together key stakeholders to discuss solutions for a safe, accessible and sustainable aviation industry in the Pacific, ultimately improving connectivity and tourism in the region and progress for all.

SPTO Chief Executive Officer Christopher Cocker “Strengthening this partnership is essential if we are to unlock the full potential of Pacific Island nations and ensure our people continue to thrive. We look forward to hearing valuable insights from Mr Hogan. Tourism and aviation are inseparable in the Pacific. Without reliable air connectivity, our islands remain isolated — but with it, we open pathways to opportunity, investment, and shared prosperity.”

Established in 1983 as the Tourism Council of the South Pacific, the Pacific Tourism Organisation (SPTO) serves as the region’s mandated agency for tourism marketing and development. SPTO promotes responsible and resilient tourism strategies to ensure long-term sustainable growth and shared prosperity across the Pacific. In addition to government members, SPTO also enlists a private sector membership base.

26 September 2025

James Hogan shares unique insights on the way aviation is developing in a special interview with Four's Group Managing Director, Ray Eglington

26 September 2025

KNIGHTHOOD ATTENDING WTTC SUMMIT IN ROME

A delegation from Knighthood Global, led by Australian Chairman James Hogan, will attend the World Travel and Tourism Council’s upcoming annual summit, which takes place in Rome from 28 to 30 September 2025.

The global tourism body’s 25th Global Summit will this year host more than 310 CEOs and Chairs, and 15 Directors, in sessions focusing on bolstering economic growth and job creation, to the power of Artificial intelligence and seamless travel.

Guided by the theme La Grande Bellezza (del Viaggio), The Great Beauty (of Travel), leaders from the public and private sectors will convene at the Auditorium Parco della Musica to forge a path forward for a sector that has proven its strength in creating jobs, strengthening economies, and fostering connections between diverse cultures.

James Hogan will be accompanied by Knighthood CEO, James Rigney, and Partner, Camiel Eurlings, the former Dutch Minister of Transport, Public Works and Water Management and Member of the European Parliament.

27 August 2025

KNIGHTHOOD PROUD TO BE A GOLD SPONSOR FOR AACO’S 58th AGM IN MOROCCO

Knighthood Global has confirmed it will once again be a Gold Sponsor of the Arab Air Carrier Organisation’s 58th AGM which takes place in Rabat, Morocco from 3 to 5 November this year, under the High Patronage of His Majesty King Mohammed VI.

The AGM is an important annual feature in the aviation calendar of Middle East and North African airlines and industry partners.

AACO is a highly respected aviation institution representing the interests of Arab airlines and providing a critical platform to address the diverse challenges of the various airlines and industry partners and sharing unique information and insights to a wider audience.

Knighthood’s delegation led by Chairman James hogan, comprises Chief Executive James Rigney and Camiel Eurlings, former Dutch Minister of Transport, Public Works and Water Management and Member of the European Parliament.

8 August 2025

KNIGHTHOOD GLOBAL CONCLUDES THREE-MONTH AGREEMENT WITH LAM MOZAMBIQUE AIRLINES

Knighthood Global has concluded its three-month contract with LAM Mozambique Airlines and has issued its end-of service report to management and the Board.

The shareholders are working on an extension to this contract and look forward to its conclusion imminently.

31 July 2025

KNIGHTHOOD GLOBAL IN KIGALI TO PARTICIPATE IN 9th AVIATION AFRICA SUMMIT AND EXHIBITION

Knighthood Global will be in Kigali to participate in the 9th Aviation Africa Summit and Exhibition which takes place on 4 and 5 September. The theme for this year’s summit is ‘Collaborating to unlock Africa’s aviation growth - how can Africa deliver a sustainable aviation industry?’

Former Group CFO of the Etihad Aviation Group and CEO of Knighthood Global, James Rigney, who has more than three decades of experience in aviation finance, will take part in the summit’s finance panel, which will examine the challenge faced by African airlines in accessing capital and how the continent can achieve a breakthrough in this critical area.

In the summit’s final session entitled ‘Putting it all together’, international aviation veteran and Knighthood Global Chairman, James Hogan, will join leadership figures from across the industry to assess the progress Africa is making and what still has to be done.

Now in its ninth year, the Aviation Africa Summit & Exhibition is an annual event bringing together aviation professionals from across Africa and the global aviation sector. The event focuses on leveraging growth in the aviation industry, addressing challenges, fostering partnerships, and exploring investment opportunities. It features discussions, exhibitions, and networking opportunities with industry leaders, airlines, regulators, airports, OEMs, and business aviation companies.

29 July 2025

JAMES HOGAN TO DELIVER KEYNOTE TO TRAVEL LEADERS IN SINGAPORE

Service at Altitude: Why Experience is the New Currency in Travel

James Hogan, Chairman of Abu Dhabi-based Knighthood Global, will deliver the keynote address at Travel Daily Media’s annual global summit in Singapore on 24 November this year.

With more than four decades leading some of the world’s most iconic airlines, James Hogan will explore how exceptional service isn’t a luxury— but the lifeline of hospitality and travel brands in a post-loyalty world.

A veteran of the global travel and tourism industry, he has played leading roles in airlines, hotels and car rental, in each of these, offering definitive leadership on excellent customer service and how it shapes major travel brands.

James will also host an exclusive, invitation-only breakfast with global travel leaders for an off-therecord discussion on ‘Rebuilding Resilience: Airlines & Tourism Beyond the Tipping Point’.

The TDM Global Summit is recognised for its unwavering focus on executive leadership and brings together over 200 of the world’s most senior travel and hospitality executives.

In the current fast paced global travel industry, the focus this year will be on transformative strategies, disruptive technologies, and the evolving consumer behaviours that are redefining the global travel ecosystem.

22 June 2025

Recently James Hogan was delighted to be invited by ecap to be a guest on their excellent “ecap Insights Podcast”

Episode 4 was a conversation about “A CEO’s Playbook from Gulf to Global” with Knighthood Global’s James Hogan AO - former President and CEO of Etihad Airways talking everything from Strategy, Scale & Growth and Managing Partner at ecap Nick Harvey.

COMPETITIVE PROCESS BRIEF – Sourcing of up to five Boeing 737-700 Aircraft

6 June 2025

Knighthood Global, mandated by the Shareholder Advisory Board of Linhas Aéreas de Moçambique (LAM), is pleased to invite proposals from qualified lessors, owners, and brokers for the supply of up to five (5) sistership Boeing 737-700 aircraft.

Knighthood Global is conducting this competitive and time-sensitive process to secure aircraft that align with LAM’s operational, commercial, and strategic requirements, either through direct purchase, finance lease, or operating lease arrangements.

Aircraft Requirements

We seek Boeing 737-700 aircraft that meet the following minimum criteria:

Age and Condition:

– Mid-life aircraft with a preference for those having undergone a recent 12-year (D-check) inspection.

– Engines, Auxiliary Power Unit (APU), and landing gear to have recent overhauls or significant maintenance completed with sufficient remaining life.

– Life-Limited Parts (LLPs) replaced or with adequate remaining life to meet operational needs without imminent costly shop visits.

Certification:

– Aircraft must be EASA or FAA certified and maintained to these standards.

Configuration and Capacity:

– Dual class cabin layout with a minimum of 120 and a maximum of 140 seats, optimised for LAM’s intra-African network requirements.

Performance and Weight:

– Maximum Take-Off Weight (MTOW) appropriate for operations across Mozambique and Southern Africa, including hot and high conditions.

– Capability to operate from airports with shorter runways and in challenging environmental conditions.

Technical Requirements:

– ADS-B Out compliance (DO-260B).

– RVSM compliant and ETOPS 120 certified (desirable).

– FANS 1/A+ and CPDLC capable avionics.

– Winglets (Blended or Split Scimitar preferred).

– Full back-to-birth traceability on all airframe, engines, APU, and landing gear components.

– No major damage history, and fully compliant with all Airworthiness Directives (ADs) and Mandatory Service Bulletins (SBs).

– Original and complete technical records to be provided in English.

– Fresh Export Certificate of Airworthiness at delivery.

– Capability for a quick change (QC) configuration is desirable, but not mandatory.

Maintenance Programme:

– Enrolment in an industry-standard Continuous Airworthiness Maintenance Programme (CAMP or equivalent).

– Current on applicable maintenance programmes with minimal bridging requirements.

Other Requirements:

– Aircraft must be delivered with a fresh check or under mutually agreed delivery conditions.

– No liens, encumbrances, or title issues at the time of delivery.

– Availability for staged delivery over the next four (4) months is preferred.

Process Outline

Proposals must clearly specify the commercial terms, including monthly lease rates (if lease), purchase price (if sale), security deposit, maintenance reserves (if applicable), and delivery conditions.

LAM reserves the right to negotiate with one or more parties and is under no obligation to accept any proposal.

All proposals will be evaluated based on a combination of technical compliance, commercial competitiveness, and delivery timeline.

Submission Requirements

Interested parties are requested to submit formal proposals, inclusive of technical specifications, maintenance status reports, and commercial terms, no later than Friday, 20 June 2025.

Contact for Clarifications and Submissions:

Manish Raniga

Director

Knighthood Global

E: manish.raniga@knighthoodglobal.com

We look forward to hearing from you.

Yours sincerely

James Rigney

CEO Knighthood Global Limited

LAM announces management restructuring

27 May 2025

The restructuring of LAM aims to contribute significantly to the increase in passenger traffic, the expansion of tourism and cargo transport

Executive Management Committee adds relevant skills to ensure LAM's restructuring and repositioning

Dane Kondic, Chairman of the Management Committee, is a manager with extensive international experience in the management and restructuring of airlines, based on the highest international standards in the aviation industry

Non-Executive Board of Directors, comprising the Chairmen of the Boards of Directors of the three shareholder companies - HCB, EMOSE and CFM, supervises the Management Committee, promoting greater institutional alignment, rigorous monitoring, and agility in strategic decisions

Since the beginning of the year, Linhas Aéreas de Moçambique (LAM) has been implementing a comprehensive restructuring process, with the aim of strengthening its operational sustainability, increasing competitiveness in regional and international markets, and ensuring the provision of an efficient, safe air transport service in accordance with international quality standards.

This restructuring responds to the challenges that the company has faced in recent years, among which the obsolescence of part of the fleet, recurring financial difficulties and growing competition in the aviation sector stand out.

The Government of Mozambique, as the majority shareholder, has reaffirmed its commitment to the revitalization of LAM, ensuring its financial viability and the modernisation of its services. This process is a strategic opportunity to boost the national air sector, mobility, and trade, reinforcing the role of air transport as a fundamental pillar for the socio-economic development of the country.

The restructuring of LAM aims to contribute significantly to the increase in passenger traffic, the expansion of tourism and cargo transport, the strengthening of links with the Mozambican diaspora, the attraction of foreign investment, the increase in tax revenues and the growth of the Gross Domestic Product (GDP). The company's experience may also serve as a reference case at national level in terms of good governance practices, sustainability and efficiency in the management of public companies.

In this context, the Government invited three strategic companies in the State Business Sector – Hidroeléctrica de Cahora Bassa (HCB), Empresa Moçambicana de Seguros (EMOSE) and Portos e Caminhos de Ferro de Moçambique (CFM) – to join LAM as shareholders, with the aim of ensuring the necessary financial support for its restructuring, based on a shared commitment to good governance and corporate sustainability.

These three companies have closely followed LAM's transformation process, being committed to contributing their experience and know-how, ensuring that this new phase of the company takes place with integrity, responsibility and a focus on creating value for Mozambique.

As part of this process, LAM now has a new Management Committee, comprising highly competent professionals with proven experience in the critical areas of commercial aviation. This team was carefully selected to lead the company's transformation, with a focus on recovering its financial sustainability, increasing operational efficiency, and providing an excellent, safe and competitive service. The members of the Management Committee are:

1. Chief Executive Officer (CEO): Dane Kondic

At 60 years of age and of Australian and Serbian nationality, Dane Kondic has a 35-year career (1989–2024) in the aviation industry, having worked from operational levels to the strategic leadership of major airlines. Kondic's extensive Curriculum Vitae also includes the following:

2021–2024: CEO and Group President of EuroAtlantic Airways and I-Jet Aviation

2013–2018: CEO and President of Air Serbia, where he led the exemplary process of restructuring and repositioning the company, expanding the fleet from four to 21 aircraft

2011–2012: Vice President of Commercial at Abacus International

2008–2010: Vice President of North Asia GTA/Travelport

2005–2007: Managing Director of Kuoni Travel for the Asia-Pacific region

He holds a Master of Business Administration (MBA) with a specialisation in International Business and Marketing from the University of Technology, Sydney, and a Bachelor of Science in Accounting and Finance from the University of New South Wales, Australia.

2. Member for the Financial and Commercial Area (CFO/CCO): Lucas Francisco

Aged 46, with 24 years of experience in the areas of Financial Management, Accounting and Auditing, Lucas Francisco has a solid track record in leading institutions. His extensive curriculum includes the following roles:

2017–2023: Chief Financial Officer of HCB, where he led the structuring, placement and sale of 7.5% of the company's shares on the Mozambique Stock Exchange and conducted financing negotiations with international banks for structuring projects

He held positions as Financial Director at British American Tobacco (BAT) in Mozambique, Angola and Zimbabwe (2010–2017)

Coordinated financial transformation projects in the Southern Africa region (2009–2010)

Senior Auditor at KPMG (2001–2003)

He has a degree in Management from Eduardo Mondlane University and has several international certifications in accounting and finance.

3. Member for the Operational and Technical Area (COO/CTO): Hilário Devis Tembe

A 60-year-old senior captain, Hilário Tembe has more than 35 years of experience in aviation, with a total of 16,500 flight hours, of which more than 7,250 as a captain. He is a respected name in the sector, with extensive technical and operational knowledge.

At LAM, he held several senior positions:

Director of Flight Operations

Head of the Training and Flight Operations Departments

Designated Examiner at the Civil Aviation Institute of Mozambique (IACM).

The objective of this Commission is to ensure, urgently and effectively, the stabilisation of LAM's operations and lead the company to a solid trajectory of sustainable growth, reinforcing its position as a strategic asset for Mozambique and as a reference in the aviation sector in Africa.

The appointment of Dane Kondic, as a foreigner, to the position of Chairman of the Management Committee, is a strategic decision of the new shareholders based on the need, due to the current situation of the company, and after successive failed rescue attempts, to bring to this transition phase, a manager with extensive international experience in the management and restructuring of airlines, based on the highest international standards of the aviation industry.

According to the careful evaluation conducted, Kondic meets the technical requirements, and offers the leadership and strategic vision necessary to give solidity and credibility to the ongoing process. The integration aims not only to ensure the professional and effective conduct of the restructuring, but also to avoid experimental approaches and promote the structured transfer of knowledge to the Mozambican teams that will remain at LAM, thus contributing to the institutional strengthening and long-term sustainability of the company.

Dane Kondic will lead the flagship company only during the restructuring period, which is estimated to be around 12 months. An international public tender will be launched to recruit the permanent manager.

A Non-Executive Board of Directors was also constituted, comprising the Chairmen of the Boards of Directors of the three shareholder companies - HCB, EMOSE and CFM. This unpaid body supervises the Management Committee, promoting greater institutional alignment, rigorous monitoring and agility in strategic decisions. As partners of LAM, it is up to these leaders to watch over corporate interests and guide the transformation process with transparency and responsibility.

The restructuring process will last one year, during which appropriate internal and external communication channels will be established, ensuring timely and reliable access to information by employees and the general public. These channels will include transparency and accountability mechanisms, ensuring participatory and accountable management.

LAM expressed its deep appreciation to its employees and reaffirmed its commitment to conducting the restructuring with humanity, ethics and rigor, in line with the best practices in human resources management, valuing and enhancing the internal skills accumulated throughout its history.

INTERNATIONAL CONSULTANTS - KNIGHTHOOD GLOBAL - APPOINTED

20 May 2025

Knighthood Global will have responsibility for advising on the restructuring of LAM's financial base, providing strategic support in the evaluation, selection and supply of aircraft suited to LAM's operational needs, and implementing information technology systems, key performance indicators and stakeholder engagement mechanisms.

As part of a structured approach, Knighthood Global will engage with LAM employees and managers.

The involvement and collaboration of all LAM employees and other relevant stakeholders will be important for this process to take place in a constructive and participatory manner and to achieve the desired results.

As part of the ongoing restructuring process at Linhas Aéreas de Moçambique (LAM), with the aim of strengthening its operational sustainability, increasing competitiveness in domestic, regional and international markets, and ensuring the provision of an efficient, safe air service that meets global quality standards, the international consultancy, Knighthood Global, has been appointed.

The contract was agreed by LAM's new shareholders – Hidroeléctrica de Cahora Bassa (HCB), Empresa Moçambicana de Seguros (EMOSE) and Portos e Caminhos de Ferro de Moçambique (CFM) – and its main purposes are:

Restructure LAM's financial base, aligning it with industry standards, reducing the level of debt and strengthening its investment profile

Provide strategic support in the evaluation, selection and supply of aircraft suitable for LAM's operational needs, contributing to the modernisation and efficiency of its fleet;

Implement information technology systems, key performance indicators and stakeholder engagement mechanisms, promoting transparency and strategic alignment in LAM's transformation process; and

Provide support in the resizing, adequacy and optimisation of the company's human resources, to ensure greater efficiency, effectiveness and increased productivity of the workforce, with impacts on the quality of the services provided, and the company's results.

This intervention aims to address structural challenges the company has faced, including the obsolescence of part of the fleet, recurring financial difficulties, and increased competition in the aviation sector.

As part of its approach, Knighthood Global will meet with various LAM employees and managers, to understand the company's operational processes and gain their insights into improving company performance. This initiative is essential to ensure the active involvement of employees in the transformation process and to build realistic, participatory and sustainable solutions.

The involvement and collaboration of other stakeholders, including the Government, public and private institutions, decision-makers, opinion leaders, the media and other relevant social actors, will also be decisive in this process, conducted by the Non-Executive Board of Directors and the Executive Management Committee, to take place in a constructive and participatory manner.

KNIGHTHOOD GLOBAL APPOINTED TO REVIEW THE REPOSITIONING OF LAM MOZAMBIQUE AIRLINES

12 May 2025

MAPUTO: International consultancy, Knighthood Global, has been appointed by the Mozambique Government to help revitalise the country’s national airline and broader aviation sector.

The focus in the first three months will be to stabilise and reposition LAM Mozambique Airlines (Linhas Aéreas de Moçambique SA LAM).

Knighthood Global’s priority will be to work with the airline’s new shareholders, Hidroeléctrica de Cahora Bassa, SA, Portos e Caminhos de Ferro de Moçambique EP, and Empresa Moçambicana de Seguros SA who have a mandate to procure the appropriate aircraft and re-establish a fleet.

Stakeholder engagement and governance will crucially underpin the advisory process in order to recreate confidence in LAM’s transformation and align all parties behind a single strategy and to address issues of the past.

In addition, the right connectivity will support tourism to Mozambique, and importantly, support the development and growth in other key sectors, including mining, oil, and agriculture.

Abu Dhabi-based Knighthood Global has a history of successfully launching and managing private and government-owned airlines and aviation groups.

Knighthood Global Appointed as Advisors to Global

• James Hogan and James Rigney appointed as strategic advisers for next stage of A380 developments

• Knighthood to become a shareholder in Global

London, Thursday, 1 May 2025

Global Airlines has appointed Knighthood Global as strategic advisers to support the next stages of its development towards operations.

Global Founder and CEO, James Asquith, will work closely with Knighthood industry veterans, James Hogan and James Rigney, who will provide key strategic advice and support, adding significant executive experience across Global’s finance and operations divisions, and supporting Global in raising finance. Knighthood will also become a shareholder in Global and will focus on the strategy for the next chapters of building the Global business, while progressing the UK AOC application.

Knighthood will also advise Global on building the required company, regulatory and operational infrastructure before expanding operations.

As CEO of Etihad Airways between 2006 and 2017, James Hogan led the launch of the airline’s flagship Airbus A380 aircraft in 2014 and the airline’s unique award-winning services.

Following an extensive interior overhaul and a comprehensive maintenance programme, the first owned Global Airlines A380, will shortly carry its first passengers with operating partner, Hi Fly.

Global intends to introduce further widebody aircraft in 2025 before announcing a timeline for scheduled operations. During the past year, Global has successfully inducted one A380 into service, and is now progressing with the acquisitions of further A380 aircraft scheduled for entry into service.

The appointment of the Knighthood Global team as key partners and strategic advisers to the board and executive team at Global highlights another key milestone in building the best team in aviation to drive the ambitious Global vision in the years ahead. As the first Global owned A380 prepares to take to the skies with its first passengers, the Global team and partners have achieved what many thought was impossible and are now focused on the next phase of development.

KNIGHTHOOD GLOBAL CONCLUDES WORK IN MALTA

23 December 2024

Knighthood Global has concluded its assignment to support the Chairman and his airline management to create a business plan for the new Maltese national carrier.

Appointed in 2022 by then Chairman and CEO David Curmi, Knighthood, in conjunction with Deloitte UK and Sabre, supported Mr Curmi and the management team at Air Malta to develop a business plan for a new Maltese national carrier when the European Union would not endorse funding for Air Malta after the Covid Pandemic.

Currently under implementation by the full new management team, the plan for KM Malta Airlines, provides a long-term roadmap approved by the European Union.

Knighthood Global Chairman, James Hogan, said:

“ I would like to wish David Curmi and his team every success as they work together to implement the plan and set KM Malta Airlines on the path to success.”

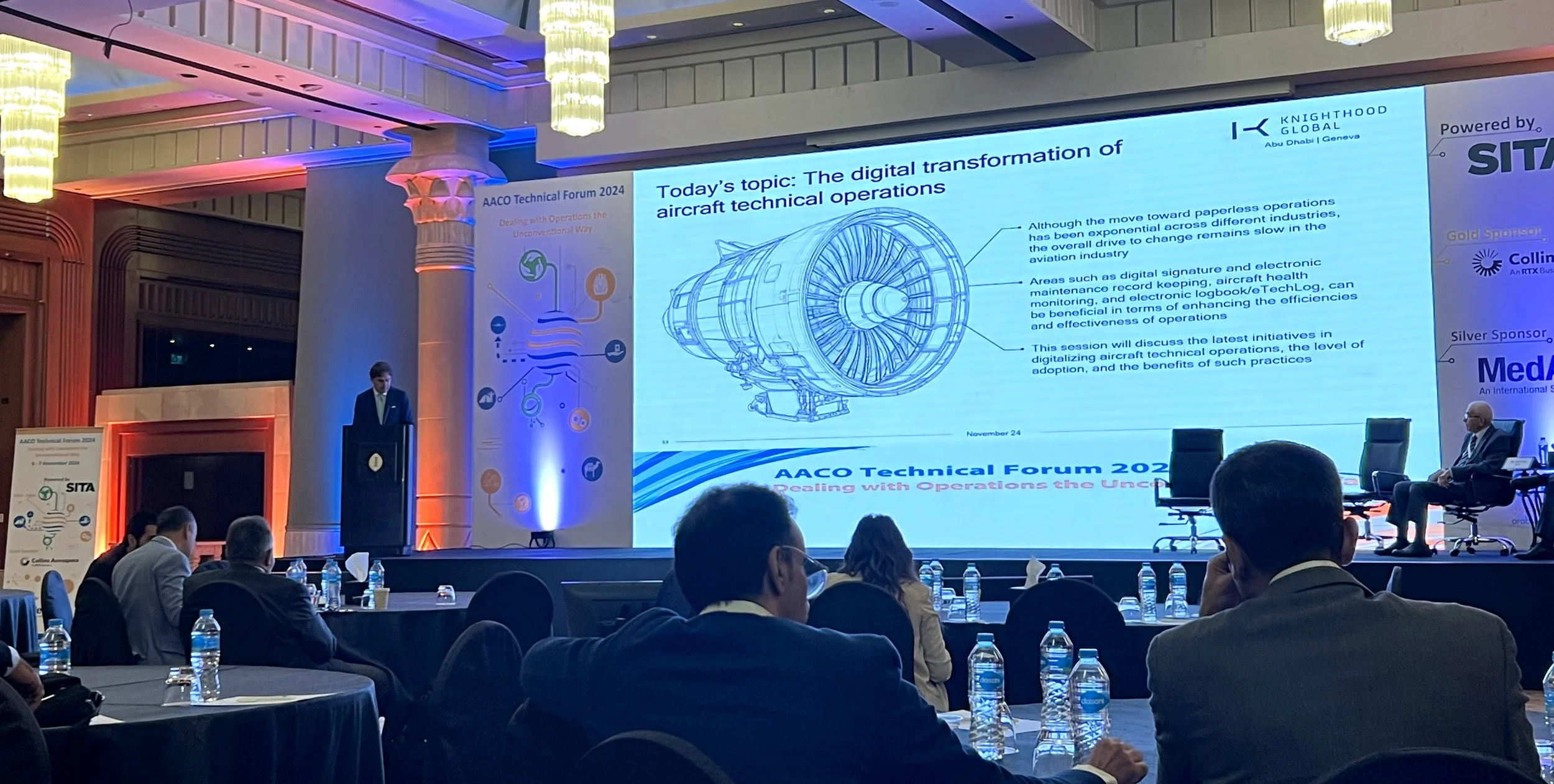

AACO’S TECHNICAL FORUM HIGHLIGHTS DIGITAL TRANSFORMATION CHALLENGES AND OPPORTUNITIES IN MENA

8th NOV 20024

Knighthood Global recently participated in the Arab Air Carrier Organisation’s (AACO) Technical Forum held in Cairo from 6 to 7 November 2024. This prestigious event brought together leading airlines and industry partners from across the Middle East and North Africa to explore critical challenges and opportunities in technical operations.

The forum focused on accelerating sustainability and digitalisation within the aviation sector. As a recognised leader in transformation and thought leadership, Knighthood Global was well represented by Partner Camiel Eurlings, former CEO of KLM Royal Dutch Airlines and Dutch Minister of Transport, Public Works, and Water Management.

Driving Industry Change Through Digital Transformation

Mr Eurlings moderated a panel discussion on the digitalisation of aircraft technical operations, joined by esteemed experts from GE Aerospace and IATA. He noted that, while digitalisation has transformed many industries, airlines have yet to fully harness its potential due to various systemic challenges.

“Significant strides have been made in digitalisation, but the progress remains inconsistent across regions and organisations,” said Eurlings. “There are clear opportunities to accelerate the adoption of transformative technologies, which will enhance operational efficiency and safety.”

Key Themes and Emerging Trends

The panel discussion delved into several pressing issues, including:

Investment and Regulation: Balancing innovation with compliance and financial constraints.

Workforce Reskilling: Preparing technical teams for the adoption of new digital tools and practices.

AI Integration: Leveraging artificial intelligence to support human expertise in predictive maintenance and real-time decision-making.

Collaborative Ecosystems: Fostering cooperation between regulators, OEMs, airlines, and MROs to drive consistent and scalable change.

A Vision for the Future

Knighthood Global continues to play a pivotal role in guiding the aviation industry towards a digital future. Through strategic partnerships, we help clients navigate complex challenges, unlock new efficiencies, and stay ahead in a rapidly evolving sector.

As the forum concluded, Eurlings emphasised the importance of collaboration: “Only by working together can we achieve the full potential of digital transformation in aviation. This is not just about adopting new technologies; it’s about fundamentally rethinking how we operate to ensure a more sustainable and resilient future.”

Knighthood Global are proud to be leading the charge in innovation and transformation, partnering with industry leaders to drive meaningful change.

KNIGHTHOOD JOINS AFRICAN AIRLINES ASSOCIATION (AFRAA) AS FULL PARTNER

Abu Dhabi – 7 November 2024

Knighthood Global has joined the African Airlines Association (AFRAA) as a full partner and will attend the organisation’s 56th Annual General Assembly and Summit later this month.

Founded in 1968 in Accra, Ghana, and now based in Kenya, AFRAA’s wide reach boasts representation of over 85% of the total international traffic carried by African airlines with more than 50 airline members and 35 aviation partners, including aircraft and engine manufacturers, aviation equipment and component suppliers, global distribution companies, IT & e-commerce solution providers and other non-airline entities in the aviation sector.

James Hogan, Chairman of Knighthood Global said: “The African continent is undergoing unparalleled growth and change. We are very pleased to share in this growth story through our partnership in an organisation which understands and embraces the critical role a sustainable safe and strong air transport industry will play in the economic development of the continent.

“We are optimistic about the many areas in which Knighthood can participate and share our expertise in airline development and transformation on this uniquely representative platform in Africa. Alongside its members and partners, we look forward to maximising the enormous learning opportunities presented by AFRAA, and to share our knowledge and experience in developing the vast potential of young people in the African aviation sector.”

A three-member delegation from Abu Dhabi-based Knighthood Global, led by Chairman James Hogan will be attending the AFRAA Summit. He will be accompanied by Knighthood CEO,

James Rigney and Partner, Camiel Eurlings.

Knighthood proud to be a gold sponsor for AACO’s 57th AGM

Nov 2024

Knighthood Global was very proud to be a Gold Sponsor of the Arab Air Carrier Organisation’s 57th AGM which took place in Jordan.

The AGM is an important annual feature in the aviation calendar of Middle East and North African airlines and industry partners.

AACO is a highly respected aviation institution. After more than half a century, representing the interests of Arab airlines, it continues to grow, providing a critical platform to address the diverse regional challenges of the various airlines and industry partners, and share unique information and insights to a wider audience.

Camiel Eurlings, former Dutch Minister of Transport, Public Works and Water Management and Member of the European Parliament, and Michael Venus, Knighthood’s special advisor on Media and International Affairs attended the event. Mr Eurlings will once more be supporting AACO when he moderates a session at its Technical Forum in Cairo from 6 to 7 November.

Thinking positive, thinking smart

After 11 years running Etihad Airways, former CEO James Hogan formed Knighthood Global and now tells Michael Doran about his new role advising airlines, airports, governments and the hospitality sector.

AIR International – Oct 2024

Glitzy award ceremonies, black-tie dinners and lavish launches are part and parcel of airline chief executive officer life. However, when Australian-born James Hogan joined Etihad Airways as CEO in 2006, he started with a blank sheet of paper, sitting in a Portakabin parked on the side of Abu Dhabi Airport.

Under Hogan’s leadership, the fledgling airline grew from a $300m business to a diversified travel and aviation group generating $20bn annually. Along the way, it placed a $43bn order for 205 new aircraft.

After leaving Etihad in 2017, Hogan formed Knighthood Global, a high-level advisory and consulting firm made up of aviation experts with extensive handson experience in global aviation, working with airlines, airports, governments and the hospitality sector worldwide.

In August, Hogan made a quick visit to his hometown of Melbourne, Australia. While there, he generously agreed to chat with Air International about his time in the airline industry, about Knighthood Global, and the state of global aviation.

Hogan talked about Etihad and fulfilling the mandate from shareholders to support the Abu Dhabi Vision 2030. The Abu Dhabi leadership saw what Singapore and Dubai had achieved by developing their city as a destination in its own right, supported by airlines, airports, hotels and tourist attractions.

The Vision was a driving factor for Hogan and his team; a strategic plan to diversify the Emirate’s economy away from oil and gas and develop new economic sectors, such as tourism, technology and manufacturing.

He said: “People don’t realise that when I went to Etihad, we had nothing, and I started in a Portakabin on the side of Abu Dhabi Airport.

“We had to build everything, and most CEOs don’t have to do that because they inherit the business, the brand and the infrastructure, but I had to do that from scratch.”

After a successful stint as Gulf Air CEO, Hogan developed a keen understanding of aviation in the Middle East and the crosscultural skills he needed to build a cohesive workforce from more than 100 nationalities.

Under his mandate, a head office, engineering centre, IT facility and global brand were also to be built, plus the vital task of designing and implementing an airline strategy.

“If you took a three-hour ring from Abu Dhabi, you had the Gulf, the Middle East and the Indian sub-continent, which is a population as great as China, and people flying from Europe or the Americas didn’t want to fly into hubs. So that meant we had one stop over the Gulf instead of going over London, then coming into another point and then to Bangalore or wherever.”

He added that Gulf Airlines will fly to cities that other carriers shun and all through the region and across Africa. That was an opportune time to ask Hogan about the impact on mega-hubs from new, longer-range aircraft, such as the Airbus A321XLR and A350 XWB operating point-to-point.

He quickly dismissed that by pointing out that hubs in the Middle East are not dependent on traffic from Australia, that Europe is a mature market where airport slots are heavily constrained, and that the real opportunity lies closer to home.

“The key areas of opportunity are India, Pakistan and Bangladesh, which are huge markets in their own right. All the secondary cities in the Middle East, where you’ll never see airlines fly into from Europe or America and all the emerging secondary cities of Africa and China – that’s the opportunity.”

When starting at Etihad, Hogan had a clear vision for the airline to be “best in class”. This vision was epitomised in 2008 when he signed one of the largest aircraft orders in history, for up to 205 new aircraft worth approximately $43bn at list prices.

He told Air International his direction was that the new Airbus A380s and Boeing 787s would be a major step change for Etihad, which is why the unique Residence at Etihad Airways, a three-room suite in the sky, was born. The Residence features an ensuite shower room, a private bedroom with a double bed and a separate living area. “We looked at the space, and after we created first class, business and economy, there was a corner space, so I said we can put a shower in there or a double bed and let’s create something special that people will go ‘Wow!’.

“From a customer perspective, the A380 is a great experience, but from an operational cost perspective and secondary market perspective, it’s not the best return. We had cabin crew who were food and beverage managers, nannies especially trained to look after kids and a butler. It was a major step change, and I’m proud of what we achieved.”

In his 11 years as CEO of Etihad, Hogan drove the airline to success. He had achieved the mandate of a competitive best-in-class airline, and Etihad carried 18.6 million passengers annually, supporting close to 92,000 jobs.

When asked about his term at Etihad and what stood out, such as challenges or learning, Hogan paused then replied:

“It was getting good people with the right skills who would become future leaders because, at the end of the day, it was Abu Dhabi’s airline. My responsibility was to ensure that they had the future leadership and talent to build, and I am very proud of doing that.”

In 2017, Hogan left Etihad. After 16 intense years running two airlines in the Gulf, he decided it was time for a change and to do something in his own right. That led to his current venture, Knighthood Global, which he set up in 2020 to offer business advisory, capital structuring and investment services in aerospace and aviation, travel and tourism, hospitality and real estate.

Hogan is chairman of Knighthood and was joined by fellow principal and CEO James Rigney – who was chief financial officer of the Etihad Aviation Group between October 2006 and June 2017. The team has an extensive list of aviation experts, partners and advisors who work with airlines, airports and governments worldwide.

Despite being offered other airline opportunities in the Gulf and elsewhere, Hogan said that after putting his heart and soul into Etihad for 11 years, he had no desire to turn out in a different coat to fight his own creation:

“It was time for a change, and I just thought that in establishing what I do, I could use my Rolodex and my skills and work at my own pace to do what I want to do and walk away or say no to what I don’t want to do,” he explained. “Which is a nice place to be.”

Almost everything Knighthood does is confidential, and Hogan only let out a few snippets here and there, but it is very clear that the group is working on a wide variety of projects around the world, from airports in the Middle East to selling an airline in Europe and the rebirth of Air Malta into KM Malta Airlines.

While the projects are private, the work Hogan and his team of aviation experts and airline managers do is not. They work very closely with the board and management, with a sharp focus on the result.

“Our role is not to take over from management, but to coach management and inform the board to create strong teamwork. What’s important to me is that we bring our experience and ensure that when we walk away, there’s a good plan in place, and the management is empowered to deliver. We’re there to support them, not take over.”

One project that can be discussed is the restructuring of Air Malta, which emerged in March this year as KM Malta Airlines, Malta’s flag carrier. The airline was formerly government-owned, and Knighthood worked with the chairman and management for around three years on all aspects of the restructuring.

“We do considerable work in Africa where they see the opportunity of what aviation brings in creating jobs. One of the biggest challenges is the large population of under-30s who lack opportunity, and without opportunity, you have disruption. We did the restructuring plans for Air Zimbabwe with the World Bank and the other stakeholders, and now they have that plan, and it’s up to them to implement it.

“So, we have airlines, we have airports, and we are just doing a deal with an African group to put some cargo aircraft in,” he said. “I work very closely with the head of Chinese airports under the Belt and Road initiative and lecture at Tianjin University.”

While consumer demand remains high, many airlines are feeling the pinch as more capacity comes online and ticket prices soften. It is clear that 2024 is not looking as financially rosy as last year, so it was a good time to ask Hogan about the state of commercial aviation.

Unsurprisingly, he was upbeat about the future and points out that aviation has always been bedevilled by cycles, whether internal or external, but there are parts of the world, such as India and Africa, that will continue to open up and create new opportunities: “There are immature airlines, youthful airlines and mature airlines and then there’s regulation, bilateral status, geography and all that impacts the model,” he explained. “The mature airlines, like British Airways, Lufthansa Group, United, American and Qantas, have their respected brands, infrastructure, talented people, routes and slots, giving them a major competitive edge.”

Another major strength of mature airlines is their well-established loyalty programmes and strong alliance partnerships, especially how they use those to distribute fares, adding to their inherent competitive advantage. At the next level, Hogan talked about the Gulf airlines, the Chinese and Indian carriers and others like Turkish Airlines, which are still developing their own models.

While the Gulf carriers get most of the attention, Hogan said that European airlines face serious competition from Turkish Airlines, with eastbound traffic over Istanbul flying out of more European cities than the Gulf airlines.

China is another developing region, and while there is a post-pandemic focus on domestic traffic, Hogan believes they will re-emerge internationally in the next few years.

“And I’ve always been very clear that I see India as a market that’s going to be a major player of the future, and in the next five years, the Indian airli nes, like the Tata Group and IndiGo, will emerge as very strong players. We go back to population, segmentation, the worldwide Indian diaspora, and the large aircraft orders they are placing all point to that.

“Then you have got the developing countries of Africa and the Eastern European countries that currently rely on Wizz, which are both huge population markets, and the low-cost airline segment as well,” he added.

“There’s high demand coming out of COVID, but we don’t have full capacity or aircraft availability, although that will change over the next couple of years. For now, it’s a honeymoon period for all airlines.”

What’s not predictable are the external shocks that come along fairly regularly and, as the pandemic showed, can wreak havoc on the aviation industry. Hogan pointed to his time in the Middle East, where he had to deal with the impacts of the Iraq and Afghanistan wars, the SARS outbreak, volcanic ash disruptions, COVID-19 and now the emergence of another possible pandemic from the Monkeypox virus.

He added: “Africa and India will emerge, and China will accelerate, so the biggest challenge today is just how you navigate airports or slots, especially at certain European and US airports, as well as aircraft availability and talent. Where are the future pilots and engineers coming from; how do you manage your people; and how do you manage your customers.”

‘One thing I’ve done is build a business from scratch, but what was unique in the Etihad role is that I was nation-building too’

September 2024. John Mulligan, Irish Independent

Age appears to be taking a gentle toll on James Hogan. Now 67, the former chief executive of Abu Dhabi’s Etihad Airways still looks youthful and energetic as he opens the door of his suite at Dublin’s Merrion Hotel.

The Aussie insists he’s not as busy – or stressed – as he was when he was running the carrier between 2006 and 2017. Maybe not, but the Knighthood Global consultancy he co-founded after he left (more of that later), still has him globetrotting and dividing his time between homes in Monaco and his native Melbourne.

He’s on a quick visit to Dublin on behalf of a client, talking to aircraft lessors.

“I’m fortunate I’ve been able to build my own business and I enjoy it,” he says.

“It gives you the flexibility to work the way you want to work.”

Since leaving Etihad, Hogan says he’s been oered roles to lead other carriers, but has declined. In 2023, his immediate successor at Etihad, Tony Douglas, was named CEO of Saudi Arabia’s new government-bankrolled Riyadh Air, that’s slated to launch next year.

Given the problems at Boeing, in particular, with aircraft deliveries, it’s clear that Hogan thinks the planned 2025 launch of Riyadh Air – whose top brass includes Irish aviation executives Peter Bellew and Ray Gammell – could be challenging.

Hogan is a veteran of the global aviation scene. His great-grandparents hail from Ireland, but it’s an Australian and British passport that he travels on.

He’s also embarked on a bit of a charm oensive, giving a rare interview in his native Australia, where he defends his legacy.

And that legacy is, whether he likes it or not, largely focused on his time at Etihad.

Abu Dhabi, having seen the success of Emirates in neighbouring Dubai, wanted to emulate the carrier and make a mark in the full-service aviation business.

James Hogan features on The Pat Kenny Show

August 2024

'No one flies to Dublin' – Experts thought Ireland's UAE flights would flop.

Aviation experts originally thought direct flights from Ireland to the Middle East would be a commercial failure.

That’s according to former Gulf Air and Etihad CEO James Hogan who said he had to overrule his own employees to get the flights off the ground.

Mr Hogan, who spent 11 years as CEO of Etihad, oversaw a significant expansion in the number of routes the company operates.

Speaking on The Pat Kenny Show, Mr Hogan said the route to Dublin was introduced following lobbying by the Irish Government.

“When I was the CEO of Gulf Air, [Bertie] Ahern was a regular visitor to Bahrain meeting the Government,” he said.

“He started pressing on me to fly to Dublin direct.

“My team said, ‘No, it doesn’t work, no one flies to Dublin.’

“But I thought hang on, let’s look at the passenger flows over Heathrow, over Amsterdam going east.”

To Mr Hogan, the numbers seemed to add up - plenty of Irish people were flying to the Middle East but they had to transit through airports in Britain or continental Europe.

“I took the decision to launch into Dublin, four flights a week,” he said.

“Then, when I moved across to Etihad, I brought in Etihad daily and double daily - a huge success.

“All of a sudden, we had an air bridge of one stop over Abu Dhabi to the Middle East, to South East Asia and Australia.

“It was a winner - not two stops, one stop.”

Other Middle Eastern airlines have since launched their own direct flights to Ireland and Mr Hogan said he feels fully vindicated in his decision.

“If you look at the market today, you have Emirates, Qatar, you have Turkish.

“So, I’m proud of the support that was given to me by Mr Ahern, Mr Cowen, Mr Kenny - great support.

“The State was great.”

GAA sponsorship

With two Irish great-grandfathers and an Irish surname, you might expect Mr Hogan to have approached his dealings with Ireland with a certain sentimentality.

However, he insists it was only ever “about business” - which is why he decided to sponsor the GAA.

“People said what are you doing, an Arab airline, supporting the GAA?” he recalled.

“It was fantastic, the brand was there in the community, we were engaged, we supported the GAA in other parts of the world - Australia and South East Asia.”

According to the Irish Embassy in the UAE, there are now over 10,000 Irish people living in the country.

KNIGHTHOOD PROUD TO SPONSOR FIRST EVER WTTC SUMMIT IN AUSTRALIA

A delegation from Knighthood Global, led by Australian Chairman James Hogan, will attend the World Travel and Tourism Council’s upcoming annual summit in Perth.

Abu Dhabi – 20 August 2024

It will be the first time the two- day summit in October has been staged in Australia.

The summit will enable the WTTC – the world’s leading travel and tourism organisation - to focus on how to maximise the country’s magnificent tourism and hospitality offering.

Knighthood Global is again a sponsor of the annual event and will this year feature on the event app which is designed to help members manage their time at the AGM and the important networking opportunities with the more than 200 global CEOs attending.

Mr Hogan said: “We are very proud to be a sponsor of this event in Perth, once considered one of the world’s most isolated cities. Today, Perth is recognised as Australia’s new gateway to the world and a magnet for investors.

“Travel and tourism will always be a significant part of that investment opportunity in a country so rich in natural resources and cultural heritage. According to Oxford Economics, travel and tourism accounts for 10.2%, or AUD 176 billion of the Australian GDP and creates 1.56 million jobs.

“As an important industry platform, I believe the WTTC can drive further investment and support the changes necessary to unlock the red tape and bureaucracy holding back further development.”

James Hogan will be accompanied by Knighthood CEO, James Rigney, and Partner, Camiel Eurlings, the former Dutch Minister of Transport, Public Works and Water Management and Member of the European Parliament.

KNIGHTHOOD PROUD TO BE A GOLD SPONSOR OF 2024 ARAB AIR CARRIERS ORGANISATION 57th AGM IN JORDAN

Abu Dhabi – 12 August 2024

A four-member delegation from Abu Dhabi-based Knighthood Global, led by Chairman James Hogan will be attending the Arab Air Carriers Organisation (AACO) 57th AGM which will take place in Jordan from 29 October to 1 November this year.

Knighthood Global is a gold sponsor of this event, which is an important annual feature in the aviation calendar of Middle East and North African airlines and industry partners.

Mr Hogan said: “AACO is a highly respected aviation institution. After more than half a century, representing the interests of Arab airlines, it continues to grow, providing a critical platform to address the diverse regional challenges of the various airlines and industry partners, and share unique information and insights to a wider audience.

“We are very proud to be a gold sponsor of this iconic event and look forward to attending the 2024 AGM in Jordan.”

James Hogan will be accompanied by Knighthood CEO, James Rigney Partner, Camiel Eurlings, former Dutch Minister of Transport, Public Works and Water Management and Member of the European Parliament, and Michael Venus, Knighthood’s special advisor on Media and International Affairs.

KNIGHTHOOD GLOBAL IN CAIRO TO SUPPORT AACO TECHNICAL FORUM

2 August 2024

Knighthood partner, Camiel Eurlings will be in Cairo to attend the Arab Air Carriers organisation Technical Forum which is being held in Egypt on 16 and 17 September this year. The theme for this year’s forum is ‘Dealing with OperaIons the Unconventional Way’.

As part of Knighthood’s ongoing support for AACO, Camiel, who is the former CEO of KLM and Minister of Transport, the Netherlands, will moderate a session entitled “Technical Operations – The Digital Transformation of Aircraft Operations’. The session, which includes presentations from IATA, Airbus and GE Aerospace, will examine challenges to accelerating the change and innovation required for a successful transformation, and look at current case studies in best practice which demonstrate the benefits of going digital.

Camiel has more than two decades of expertise as a public policy maker and broad experience as corporate leader in aviation.

Prior to joining Knighthood Global, he worked as an independent consultant, and served as President and CEO of KLM Royal Dutch Airlines following his tenure at the helm of the cargo divisions of Air France-KLM and Martinair. He was also a member of the Alliance Steering Committee of the Board of Gol Transportes Aéreos and the IATA Cargo Committee, and is a former Member of the Board of Directors of American Express Global Business Travel.

He holds a Master of Science in Industrial and Management Science (Cum Laude) from Eindhoven University of Technology. He is also an Officer in the Order of Oranje-Nassau and a Knight of the Order of the Holy Sepulchre.

Knighthood is also a gold sponsor of AACO’s 57th AGM which will be held later this year in Jordan. A four-person delegation led by James Hogan is set to the attend this important annual event.

KNIGHTHOOD GLOBAL CELEBRATES ARRIVAL OF NEW AIRCRAFT FOR KM MALTA AIRLINES

24 July 2024

Knighthood Global is delighted to celebrate with David Curmi and his team at KM Malta Airlines the arrival of its new Airbus A320 at Malta International Airport. Knighthood is very proud to have played a role in this exciting development.

Congratulations!

KNIGHTHOOD GLOBAL APPOINTS NEW LEGAL ADVISOR

Abu Dhabi – 19 July 2024

Knighthood Global has appointed Ashley Whitcher as its legal advisor. He will provide ongoing legal counsel, supporting Knighthood’s projects with governments, and private and public sector clients.

He is currently the Consultant Solicitor at In Verrem Limited which he set up in 2020 to support the aviation legal market with full-service commercial aviation law expertise. Ashley brings deep expertise in corporate governance, international mergers and acquisitions, international dispute resolution, and complex governmental and commercial contract negotiations.

He formerly served as Head of Legal and Legal Counsel in the United Arab Emirates at Etihad Airways, and as Executive Vice President Legal and Group Head of Legal at John Menzies Plc, a FTSE Small Cap listed plc.

He graduated with a Bachelor of Laws, LLB, Honours from De Montfort University in 1997 and was admitted as a Solicitor of the Supreme Court of England & Wales in August 2000, and as a Solicitor- Advocate (All Proceedings), in September 2004.

Knighthood strengthens core team with two new executive appointments

Knighthood Global has appointed Michael Venus and Manish Raniga as directors of its Abu Dhabi based business.

Abu Dhabi – 17 July 2024

Both senior and experienced executives, their deep expertise will strengthen the core team and diversify the broad advisory offering Knighthood provides to its government, private and public sector clients.

Michael Venus, who is a seasoned international public affairs and corporate communications executive, spent seven years as Director of TV News with Australia’s Nine Network in Melbourne before joining Etihad Airways as its Vice President of Corporate Affairs where he led the airline’s global communications strategy from 2010 to 2017 when he returned to Australia. More recently he was Director of Media and External Relations for Rex, Australia’s largest independent domestic and regional airline. Michael will oversee Knighthood’s international media and communications strategy and support its current projects in areas of communications and media advisory.

Manish Raniga began his diverse 25-year global career at PWC after completing his Bachelor of Economics at the University of Queensland, Australia. In addition to strategic and financial roles at Etihad Airways, Jet Airways, and at South African Airways as Chief Commercial Officer, he has held senior advisory and executive roles, most recently for a US-based private equity firm leading its aviation investment portfolio. Manish brings financial acumen, data-driven analytical decision making and strong tech innovation to the team.

‘Cut me in half, I’m still Etihad’

Over lunch in Dubai, former CEO James Hogan tells our Editor-at-Large how the “Middle East model” took over aviation – and what really happened at Etihad.

By Frank Kane, June 10, 2024

James Hogan, left, and Frank Kane at Shanghai Me

When I arrive 20 minutes early for lunch at Shanghai Me in the DIFC’s Gate Village, James Hogan is already there, poring over his phone, beneath a stylised portrait of Mao Zedong.

It is an incongruous sight – an Australian leader of the global aviation industry who spent the bulk of his career in pursuit of elite standards of luxury air service, alongside a hot pink version of the drab olive-green tunics worn by hundreds of millions by bicycle-riding workers during Mao’s tumultuous decades as chairman of the Chinese Communist Party.

But I’ve chosen Shanghai Me for several reasons. Hogan loves Asian food, his aides told me, and spends some time these days as a visiting lecturer on the MBA course at Tsinghua University in Beijing.

And, as I discovered, he has some pertinent views on the importance of China in the global aviation market.

“I thought the traffic would be worse,” he says to explain his timing, “and I hate being late for anything.”

This lunch has been a long time in the making.

Hogan has given few full media interviews since his departure from Etihad Airlines in 2017, after a transformational 11 years as chief executive.

Over those years Abu Dhabi’s flagship carrier went from being a $300 million startup to become a diversified travel group with more than $6 billion in revenue, pulling in nearly $10 billion for the emirate as a result of the economic “multiplier” effect of a major aviation hub.

Despite this strategic success, he saw his legacy ripped apart by subsequent policymakers – the fleet shrunk, destinations dropped, international alliances canned – in a long programme of retrenchment compounded by the pandemic-induced recession.

Only now, with Etihad on a revived growth trajectory under CEO Antonoaldo Neves and even looking to launch an initial public offering of shares, is the airline getting back to where it was in 2017.

I knew that Hogan wanted to talk about the slings and arrows of what had happened at Etihad, but also realised it was still a sensitive subject.

So, what better than a pleasant lunch, away from the office, to get to the bottom of it?

JAMES HOGAN INDUCTED INTO ATW HALL OF FAME

Dubai: Aviation visionary James Hogan has been honoured at Air Transport World’s 50th annual awards ceremony in Dubai.

2 June 2024

In front of an audience of airline CEOs and aviation industry leaders on Friday night, James was inducted into ATW’s Awards Hall of Fame.

The honour was bestowed in recognition of his leadership as President and Chief Executive of Etihad Airways between 2006 and 2017.

During the Hogan-era Etihad was transformed from an airline with revenues of US$300 million into a diversified travel and aviation group generating US$20 billion annually.

In 2016, Etihad was ATW’s Airline of the Year for “demonstrating exceptional achievements and capabilities across operations, financial performance, customer service, safety and labour relations.”

Today, James is the Chairman of Abu Dhabi-based Knighthood Global, a specialist aviation, travel and tourism company which provides turnkey strategic planning and operational support capability solutions to governments, airlines, and travel and tourism organisations.

James said he was delighted to be a Hall of Fame recipient and thanked ATW’s Editor-In-Chief Karen Walker for her support over many years, and acknowledged the leadership of Abu Dhabi and the mandate it gave him to create a world class airline as part of the 2030 plan.

“ATW rightfully enjoys an international reputation as an authoritative source of news and knowledge in the aviation industry. This is largely due to Karen’s integrity and commitment as an editor, chronicling the ups and downs of global aviation while celebrating its achievements. I am honoured to be part of this remarkable story,” James said.

ETIHAD GOES BACK TO THE FUTURE

By Anil Bhoyrul, Managing Director, Arabian Business

The UAE’s national carrier Etihad is on course for remarkable growth under new leadership, with talk of an IPO. For new CEO Antonoaldo Neves, the strategy looks set to take the airline to new heights.

22 May 2024

Remember this? Etihad Airways and its ambitious CEO making a host of announcements to “usher in a new phase of sustainable growth, underpinned by a robust strategic plan.”

The dizzy heights of carrying 18 million passengers a year were floated, and a network that would expand to 125 destinations. This “pivotal turning point in the carrier’s journey” was also heavily laden with the X-factor: Flight EY1 touched down at John F. Kennedy International Airport in New York, showcasing the A380 double-decker service featuring the Residence, a three-room suite in the sky. In a handful of years, the fleet size would be over 150.

But no, this wasn’t May 2014 when the then Group CEO James Hogan outlined the airline’s spectacular vision at a spectacular event in Abu Dhabi, in front of the world’s media.

This was just five months ago, as new Group CEO Antonoaldo Neves laid down his own marker. If it all sounds familiar, it’s because it is. Ten years later, with a global pandemic to deal with in between, Etihad Airways is back – and back to the future.

Etihad Airways 2030 strategy

Neves recently spelled out in detail the “Etihad Airways 2030” strategy, backed by ADQ Holdings. A network of 125 destinations are part of the 2030 plan, to link Asia and Europe. And a focus on connecting short and medium-haul destinations in the GCC, India, and Asia with long-haul destinations in Europe and the East Coast of America.

“In 2017, our fleet peaked at 110 aircraft, and we worked on reducing the fleet size between 2019 and 2022. Today, we are witnessing the return of our large aircraft such as the Airbus A380, Boeing 787, and Boeing 777, resulting in an increase in our fleet to 86 aircraft, and we expect it to reach a total of 160 aircraft by 2030,” said Neves.

The airline currently flies to over 70 destinations worldwide, having launched 12 new destinations last year. The announcement marks a return to the pre-Covid growth strategy undertaken by Hogan, which after his departure in 2017, was largely ditched by his successor Tony Douglas.

Last year Douglas himself departed, with Neves now effectively skipping the seven years between himself and Hogan to once again make Etihad a world beater. The missing years, the lost years, call it what you like, no one can argue that the Etihad giant has been awakened and is once again taking its rightful place on the global airline stage.

But this time around, will it stay there? Neves has zero doubt and is even entertaining talk of an IPO to fund expansion. The omens are good, considering Etihad has pretty much been down this growth road before with huge success.

Three eras defined

Etihad has effectively had three lifespans – Etihad v1, the Hogan years, Etihad v2 the Douglas years and Etihad v3 – Neves at the helm.

In fact, the numbers for v1 and v3 look remarkably similar, and are sure to fuel investor appetite if an IPO does take shape.

The Etihad V1 version spanned 11 years, with Hogan taking the helm after a four-year stint as boss of Gulf Air. Etihad Airways had been created in 2003, with a vision “to redefine air travel, connecting the world through our hub at Abu Dhabi International Airport,” it announced at the time. On 12 November 2003, the first Etihad flight – to Beirut – took off, and less than a year later, $8 billion of plane orders were made.

When Hogan arrived, Etihad was a three-year-old airline with $300 million of revenues. When he departed in 2017, it had grown into a diversified travel and aviation group generating $20 billion annually. The Etihad brand became known worldwide, supporting the wider brand of Abu Dhabi as an important centre for business, trade and tourism.

James Hogan’s vision and strategy were shaped by the mandate from the airline’s shareholder, the Government of Abu Dhabi. This mandate stipulated the creation of a competitive best-in-class global airline, synonymous with the premium brand of Abu Dhabi, and the development of a business that would support and enable the Abu Dhabi 2030 economic plan by contributing to the emirate’s economic growth and development.

Abu Dhabi’s aviation infrastructure

The creation of Etihad Aviation Group brought together critical elements of Abu Dhabi’s aviation infrastructure including Etihad Airways, Etihad Airport Services, Etihad Engineering, Etihad Aviation Training and Hala, a holidays division, driving significant financial and operational benefits as a direct result of the alignment created by this strategy.

By 2017, Etihad was carrying 18.6 million passengers, creating more than 91,700 jobs in Abu Dhabi and across the world and delivering $6.1 billion in revenue. Its economic impact to the emirate of Abu Dhabi was estimated by Oxford Economics to be more than $9.6 billion. In less than a decade, James Hogan had led the business to become one of the fastest- growing airlines in history. As an organic growth story, Etihad’s development was unprecedented.

Etihad also operated at a level of financial transparency unprecedented for a new national carrier. It started publishing annual reports in 2010, and shared full financial details with institutions around the world.

With two of the world’s most successful and well-established ‘mega-connectors’ on its doorstep, in Emirates and Qatar, organic network growth could not be enough, however. Etihad could not build the feed traffic on its own to serve a global network that could compete against these two much longer-established competitors.

To complement the airline’s organic growth and overcome bilateral and slot constraints, and meet the mandate set by the Government of Abu Dhabi, Etihad developed its equity alliance strategy. This used minority investments in other airlines – these were minority investments, which provided the only expansion option possible within the airline industry’s regulatory framework.

In December 2011, Etihad became airberlin’s largest single shareholder with a stake of just under 30 percent (and gaining access to 33 million new passengers). In January 2012, Etihad paid $20 million for a 40 percent stake in Air Seychelles, whilst in April 2013 it took a 24 percent stake in India’s Jet Airways for $379 million. Four months later, a 49 percent stake in the newly branded Air Serbia was agreed, followed by a 33 percent stake in Swiss regional carrier Darwin Airline – and in 2014 a 49 percent stake in Alitalia.

Securing Etihad’s future growth

Etihad appeared unstoppable, having also in November 2013 made the largest ever fleet order, for 199 aircraft and 294 engines in a deal worth $67 billion, which would have secured the airline’s future growth and competitive position out to 2040.

As for the equity investments, they more than recovered the outlay cost for their acquisition. They significantly increased passenger numbers on to Etihad’s network, including travellers into Abu Dhabi, in line with the management mandate at the time. Etihad led initiatives to provide shared services which generated their own revenues streams, while also offering efficiencies for the equity partners.

India, then one of the world’s fastest growing aviation markets, epitomised the benefits of such a strategy. The investment in Jet Airways enabled Etihad almost overnight to match the number of seats Emirates had to India and by early 2017 Etihad and its strategic partner offered 280 flights a week between Abu Dhabi and 18 Indian cities.

These investments also ensured the continuity of airlines that were facing significant financial and operational pressures, airberlin and Alitalia would have gone into administration with thousands of jobs lost, were it not for capital injections and aviation expertise of Etihad over a period of years.

Of course, not all of it was smooth sailing. The new funding for Alitalia allowed it to develop a business strategy which was implemented from 2015 and delivered significant improvements to the business. In 2015, the Italian carrier’s losses dropped dramatically to EUR 199 million, from EUR 580 million the previous year. The plan was predicated on a number of strategic initiatives which required the collaboration of the Italian government. Unfortunately, these did not materialise, to the detriment of the business and Alitalia went into administration in 2017.

Nevertheless, by the time Etihad v1 came to an end, Etihad was also strongly positioned for growth in 2017.

Performance and financial position

Etihad had one of the strongest balance sheets in the industry, including $14 billion in equity. The airline, which had recorded successive independently audited profits from 2011 to 2015, was awarded a financial credit rating of ‘A’ from Fitch Ratings in 2015, a rating still held today.

In addition to its underlying performance and financial position, it had recently signed a memorandum of understanding with Lufthansa and TUI, to deliver a wide-ranging growth strategy across a range of markets, alongside airberlin.

The deal was a potential gamechanger and involved the creation of a leisure airline juggernaut by combining the touristic operations of the airberlin group and the German TUIfly company, including aircraft being operated by TUIfly for airberlin under a wet-lease agreement. This new airline group was to serve a broad network of destinations from Germany, Austria and Switzerland.

Harnessing the strengths of both the Etihad Aviation and TUI groups would have opened a world of opportunities for both entities – and Abu Dhabi – as the TUI group portfolio then included more than 300 hotels, 14 cruise liners, six European airlines with around 140 aircraft and a wide-reaching distribution network, covering more than 1,800 travel agencies and online portals.

But in 2017, Hogan confirmed he was departing – to be replaced by Tony Douglas, who had been chief executive of Abu Dhabi Airports.

Leadership V2

Douglas officially took over in January 2018, but a good two years before the chaos of Covid, quickly began taking the airline and group in a totally new direction.

The new Etihad management chose to withdraw from that growth strategy, cancelling the TUI agreement, and stepping back from the close engagement with Jet Airways, Air Serbia and Air Seychelles.

Between January 1 2017 and May 31 2023, Etihad’s fleet decreased from 119 to 76 aircraft, representing a reduction of 43 aircraft or 36 percent.

Over the same period, Etihad’s aircraft order book decreased from 176 to 92 aircraft, representing a reduction of 84 aircraft or 48 percent. This decrease was primarily driven by the cancellation of some aircraft orders placed in 2013 for 48 Airbus aircraft.

In July 2022, Douglas, in an interview with the Daily Telegraph, summed up his time during Etihad v2: “We’ve had to reduce our employees from 29,000 down to 8,500 today. We’ve reduced the number of different aircraft types in our fleet from a massive, diverse fleet down to what I would describe as a two- horse stable with the 787 Dreamliner and the [Airbus] A350-1000. We’re an 18- year-old company. And we’ve made some pretty fundamental mistakes, you know, earlier on in our teenage years. And that’s why, for the last five years, we’ve had to go through the real challenge of a transformation that’s now delivered the results in a market that’s recovering.”

That turned out to be one of his last interviews, with Arabian Business breaking the story in September 2022 that Douglas was already planning to leave Etihad to join the new Saudi airline Riyadh Air – a month later his successor Neves was announced.

Etihad V3

His own successor – now in charge of Etihad v3, has now effectively signalled a move back towards the strategy of Etihad v1. So quick has Neves been on the return to growth plans, the website AGBI reported in February that the airline was now outsourcing some plans as it didn’t have enough capacity within its own fleet.

Neves outlook for the future is an impressive looking growth map. Speaking at the Dubai Air Show in November last year, Neves unveiled details of Journey 2030, described as the “guiding plan that propels Etihad into the future.”

Between November 2022 and 2023, the airline carried 13 million passengers, a 30 percent increase from 2022. Through Journey 2030, Neves said this growth trajectory is set to continue, projecting a return to Etihad’s peak in 2017.

Since leaving Etihad James Hogan has rarely agreed to be interviewed and when approached by Arabian Business, he was reluctant to comment beyond saying:

“I am delighted to see Etihad is back on track and returning to the pre-2017 roadmap for growth. Reinvigorating the former fleet and network growth strategy will help the airline better compete with strong neighbouring airlines and new regional entrants.”

He was, however, happy to laud the vision and guidance of the then Crown Prince of Abu Dhabi – and now UAE President – Sheikh Mohamed bin Zayed Al Nahyan.

“It was both an honour and a privilege to implement his mandate,” Hogan said.

He also paid tribute to Khaldoon Khalifa Al Mubarak, describing the Mubadala Managing Director and Group Chief Executive Officer as “an extraordinary businessman who provided invaluable support during his 11 years at Etihad.”

As a business, it has been a story of many stops and starts, different flight paths and landing routes. But nearly 21 years since the first flight to Beirut, only a fool would bet against the airline’s future as a global giant.

AIR SERBIA’S DECADE LONG SUCCESS IS A WIN FOR SERBIA